Cash collection automation

If you’re running a company, you’ve probably heard the phrase “cash is king.” And this concept cannot be overemphasized. Without a steady influx of cash, your organization will be unable to cover its bills, expand operations and ultimately, stay in business. In order to be “default alive”, cash collection is one of the most important tasks.

Today, more and more companies are looking for ways to lengthen their runway. One option is to get better at collecting cash.

It’s a topic about which Jason Lemkin, from SaaStr, has been actively raising awareness, way before the current economic turndown. The following tweet is a good example:

It may be the right moment to make a switch from manual cash collection to an efficient automated system.

It’s no surprise that the cash collection/accounts receivable (AR) automation market is projected to grow from $1.7 billion in 2019 to $3 billion by 2024. If you’re late to the party, now would be the time to hop on the cash collection automation bandwagon.

With this comprehensive guide, we’ll cover the basics of cash collection automation. Let’s dive in!

What is cash collection software?

Cash collection software, also known as accounts receivable software, refers to programs that automate a company’s credit management, invoicing, payment collection, reconciliation, and other accounts receivable processes.

Cash collection 1o1

While accounts receivable tasks are critical to the viability and success of a business, they can be time-consuming and very repetitive. To understand this better, let’s take a closer look at the manual cash collection process.

First, the cash collection team (or individual) will have to generate an invoice bearing relevant information on the sale. Next, they will send this invoice to the customer in a timely manner. The invoice may then be followed by a couple of reminders depending on the company’s policy. And if an invoice is overdue, the AR team is responsible for resolving the issue with the customer.

When the customer has cleared their outstanding invoices, the cash collection department will reconcile the invoice with the payment, update their records, and issue a receipt for the transaction.

Days sales outstanding: the key metric to monitor

The north star of cash collection is to reduce the number of days sales outstanding (DSO). DSO measures the average number of days it takes to convert credit sales into cash. A high DSO number indicates that a business is experiencing delays in collecting money for its credit sales. Needless to say, this can create cash flow issues for the company. A low DSO, on the other hand, suggests that a business is getting the cash it needs to survive (and thrive) on time.

Automating the cash collection process ensures that invoices and reminders are sent out on time, therefore reducing DSO while keeping customers happy when dealing with this sensitive topic.

For most companies, cash collection remains a tedious spreadsheet-based process. However, it does not have to be. Cash collection software is a relatively new component of the pricing stack. When integrated with billing software and internal processes, it can have a positive impact on several areas of the business and generate a return on investment.

Better for your business

Today more than ever, overlooking cash collection software is simply not an option. However, if you still need to be convinced, let’s take a look at the importance and impact of accounts receivable automation.

Faster payments = lower working capital needs

Every business owner has come across a client who clears invoices at will. In fact, according to a report by EXIM, 6 out of 10 invoices are paid late. Now, imagine that you’re dealing with several of these clients. Your accounts receivable would quickly add up resulting in a cash flow problem that can strangle your business.

An automated accounts receivable system is a great tool to speed up your payments. For starters, cash collection software will send out invoices and reminders on time. In addition to this, an automated system can process significantly more invoices at a lower cost, and therefore, money comes in quicker. This improves the company’s cash position and lowers its working capital needs.

Reducing involuntary and passive churn

Involuntary churn can be quite a hurdle for subscription-based businesses. And given the cost of acquiring versus retaining existing customers, which business does not want to keep their clients coming back?

You can leverage cash collection software to automatically send card expiry notifications, user satisfaction surveys and product marketing communications as needed. In the event that a customer's payment method is declined, these programs allow for smart retries – a feature that avoids bothering customers.

A customer who does not pay their invoices on time can also be a sign of low satisfaction and passive churn. Identifying these situations as proactively as possible and engaging with these users can also contribute to controlling the churn rate.

Better for your team

A common misconception is that automation is designed to replace employees. This is not the case. By implementing cash collection software, you free up your team from important but very manual processes. An automated and streamlined system means that cumbersome tasks can be completed with just a couple of clicks.

Your employees can then focus on strategic and fulfilling tasks. This is a step towards a happier team and more positive company culture.

Better for your users

Automation can help your business create and maintain stronger relationships with your clientele. When your employees are not staring at numbers and spreadsheets all day long, they will focus on other tasks, including customer service issues.

A streamlined system creates new ways to sort out billing related customer issues, which often ranks in the top 3 sources of customer inquiries. In the event of an inaccurate or misplaced invoice for instance, resolution is as easy as accessing the system and instantly rectifying the error.

Which cash collection solution should I choose?

Before benchmarking solutions, we thought it would be useful to list the criteria you should use to choose the cash collection software that best suits your needs.

Integration with your billing system

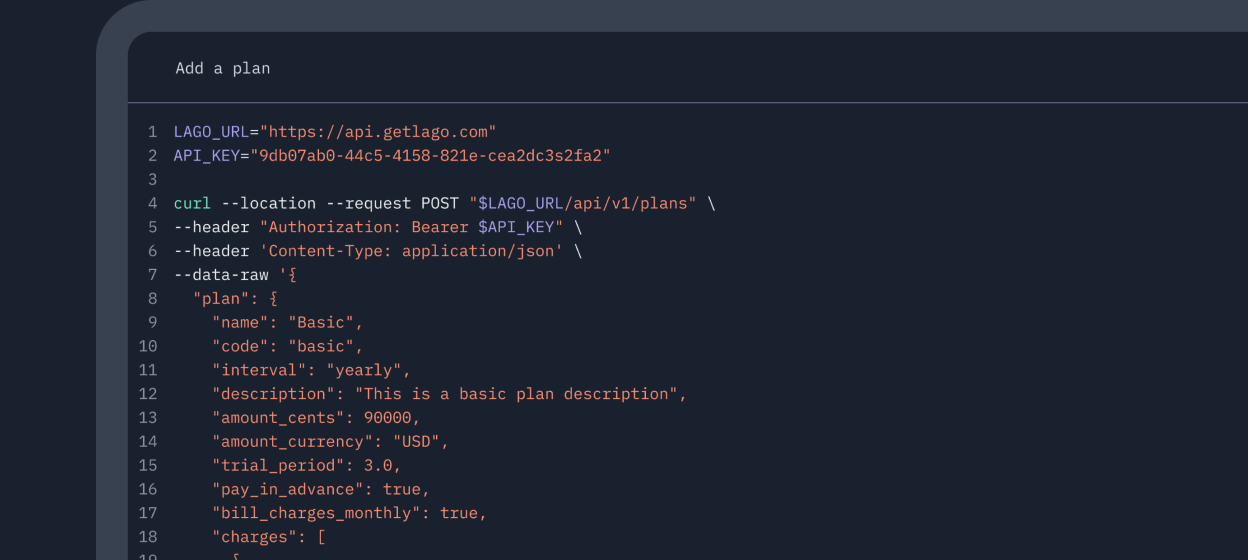

Your cash collection software should always be able to access up to date billing information. Therefore, make sure it has either a native integration with the billing software you use (if you use an off-the-shelf solution such as Lago, Stripe Billing, Chargebee or Quickbooks for instance), or a well-thought-out API your home-grown billing system can connect to.

The API will provide you with maximum flexibility. Ask your engineering team to evaluate the quality of the API, because at the end of the day, they will be the ones using it.

Modular collaboration features to be able to handle ad hoc context

Cash collection is a sensitive topic. Inefficient cash collection can lead the company to bankruptcy and failing to collect a payment can impact a sales rep’s commission and their income. However, being insensitive when asking a customer to pay their invoice can break a hard-won relationship.

The key is to be able to add context before automating anything. For instance, you might want to tag a VIP customer as requiring high-touch attention, wait for the next in-person meeting to inquire about the payment before sending any reminder, or pause the reminders until an upselling negotiation is closed.

This requires the solution to enable collaboration between the sales, customer success, and finance teams. It will also need to be able to ingest contextual information that will then be used to design granular workflows. This is not an easy task, but it’s what it takes to bring automation to a highly sensitive and cross-functional process.

Payment features

To collect cash in an efficient way, it should be easy for the customer to… proceed to the payment. If your AR solution includes a way for your customer to receive a reminder, combined with an easy way to pay, it greatly improves the whole experience for both the customer and AR team.

Although this seems obvious, it usually involves offering a variety of payment methods: paper checks are still very much in use in the US, not all card processing gateways work in all geographies, some merchants would prefer to implement direct debit, some companies don’t allow it, and the list of edge cases goes on. Therefore, a good rule of thumb is to ensure that:

- Your AR solution offers several payment options; and

- These payment options meet your customer’s expectations.

Communication channels

Some communication channels resonate with particular customers or sectors. For instance, you might need to send snail mails to procurement departments and use WhatsApp reminders for other customers. You should ensure that your AR solution fits with your customers’ favorite communication channels.

Analytics for the finance team

Thanks to the AR solution, it should be easier for the finance team to have a global view on the average DSO, the amount to be collected, and efforts that have already been deployed.

Customer Portal

Customers rarely have an easy way to see what they still owe and if their payment was actually processed. Some AR solutions enable merchants to easily build a branded “customer portal” for their customers, so you should check for this feature as well.

That’s all for today!

In our next post, we’ll dive into five of the best AR software on the market, including:

Two hosting options, same benefits

Whether you choose the cloud version or decide to host the solution yourself, you will benefit from our powerful API and user-friendly interface.

Open source

The optimal solution for small projects.

Premium

The optimal solution for teams who want control and flexibility on cloud or self-hosted version.