Product

Entitlements and billing should be the same system

Finn Lobsien • 5 min read

Apr 20, 2023

/4 min read

Lago’s DNA is deeply rooted into the Fintech ecosystem, we built Qonto’s (a French Unicorn with 220,000+ business users and 1,000+ employees) billing and monetization system from day 1 to series D, and that shaped our approach when building Lago.

Indeed, Fintechs have unique needs and ‘superpowers’, compared with other software companies. One of them is to be able to charge fees by intercepting a cut directly from the ‘flow of funds’ they manage.

In other words, Fintechs are ‘closer to the money’ and can get themselves paid directly and ‘instantly’ when an end-user performs an action.

For instance when an end-user initiates a transaction that incurs fees, a Fintech will take a cut on that very same transaction. E.g., you send USD 1000 to an EUR account using Wise.com, Wise would take their 0.5% fee directly from the USD 1000 amount.

If your company is a neobank and you charge $1 per ATM withdrawal, if your end user withdraws $100, you would either take the $1 fee from the $100, and the end-user would end up with $99 in hands, or debit the end-user account of a total amount of $101, while the end-user ends up with $100 in hands.

To enable Fintechs to leverage this ‘superpower’, we developed a feature we called ‘instant charges’ ⚡️.

Instant charges are fees that are due as soon as the corresponding ingested events occur (in our previous examples: a transaction or an ATM withdrawal), as opposed to standard charges that are due at the end of the billing period (e.g., typically if you’re making international calls on March 15th and it’s not included in your T-mobile subscription, you’ll only pay the overage for that call by March 30th when you receive the invoice).

This is a real ‘unfair advantage’ fintechs have over other software providers, as collecting charges instantly improves their cash flow and reduces the risk of late payments, so we’re excited to support it!

In this article, we will explore the concept of instant charges and how they work.

This feature is actually needed by most Fintechs, including Payment processors, Neobanks, Banking as a Service (BaaS) providers, and Fintech API platforms.

It caters to the needs of businesses who require immediate collection of fees without the hassle of waiting until the end of the month, quarter or year.

In Lago’s documentation and product, instant charge appears as a Charge paid in advance.

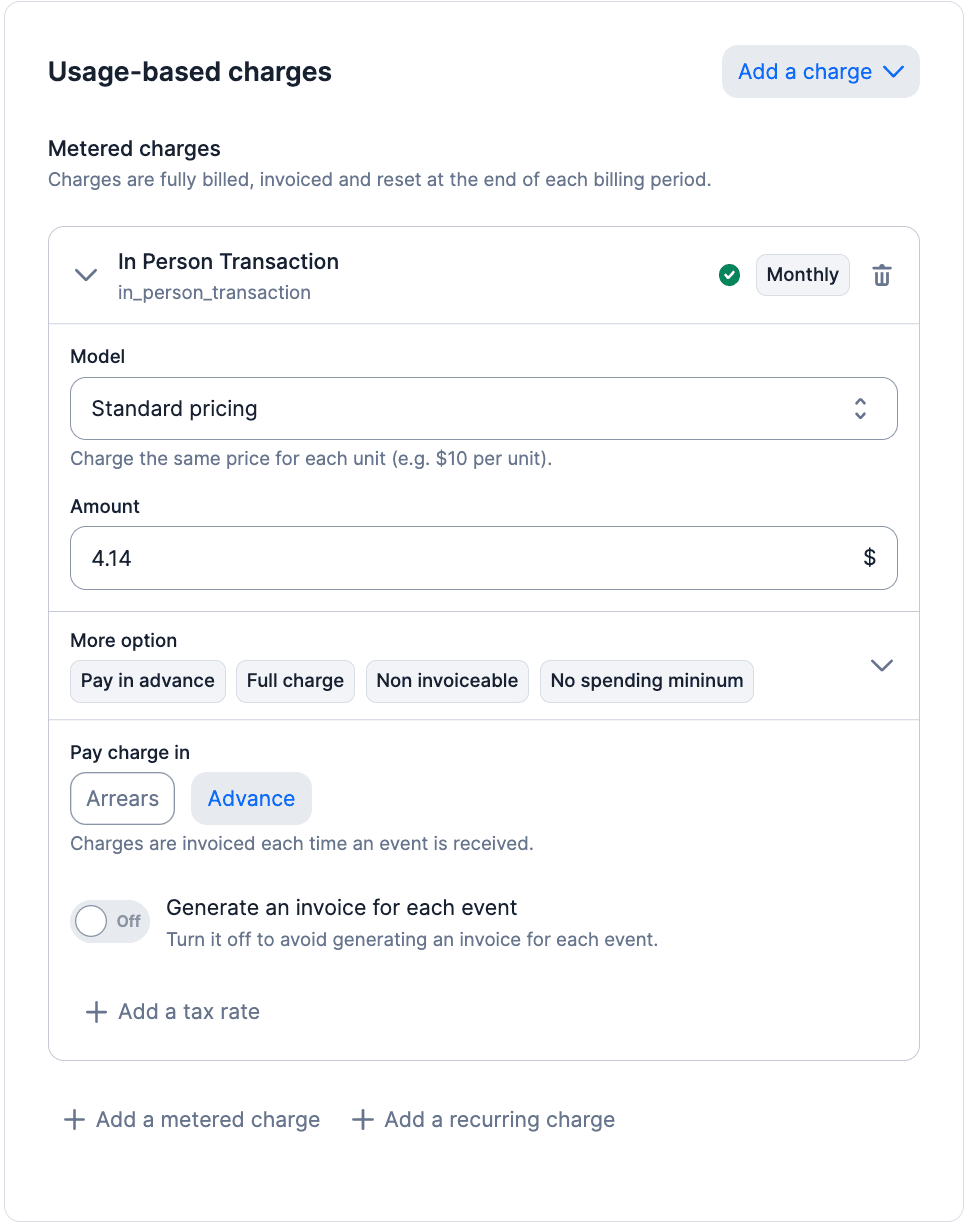

Let’s say you want to charge your customers with a fixed fee whenever they receive or send a certain type of payment. That’s what Wise do, as they charge a fixed fee of around USD 4 in that case.

Here is how you’d replicate a similar pricing, effortlessly, within Lago:

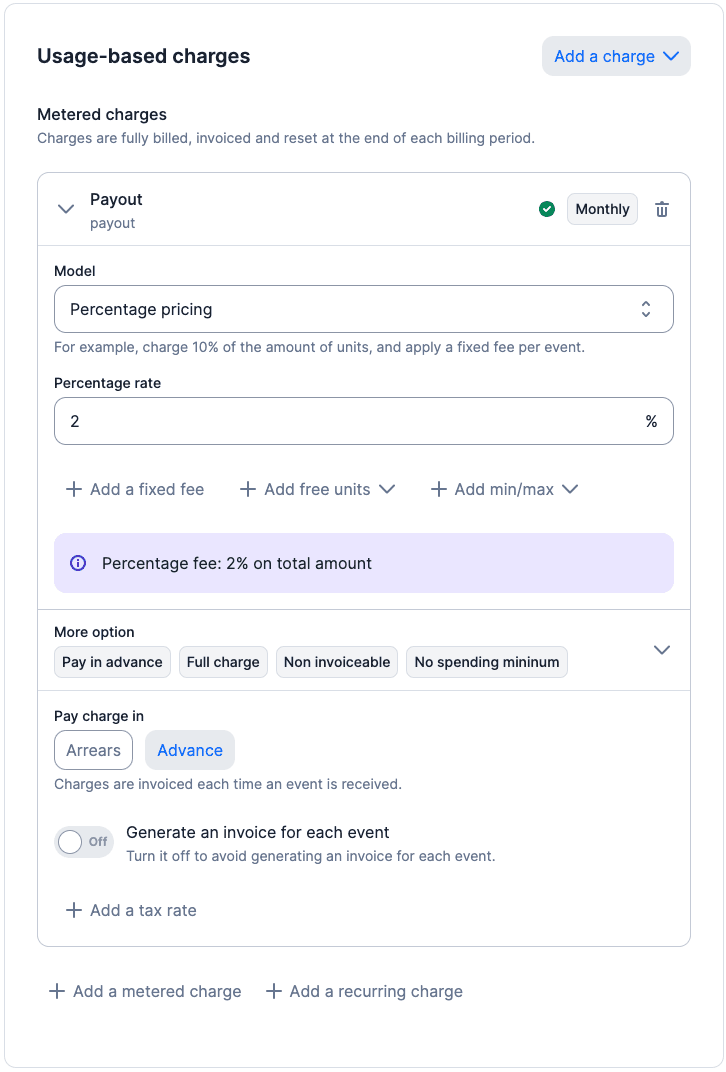

Razorpay (the dominant payment processor in India) charges a 2% platform fee on every transaction.

Here is how you’d replicate a similar pricing, effortlessly, within Lago:

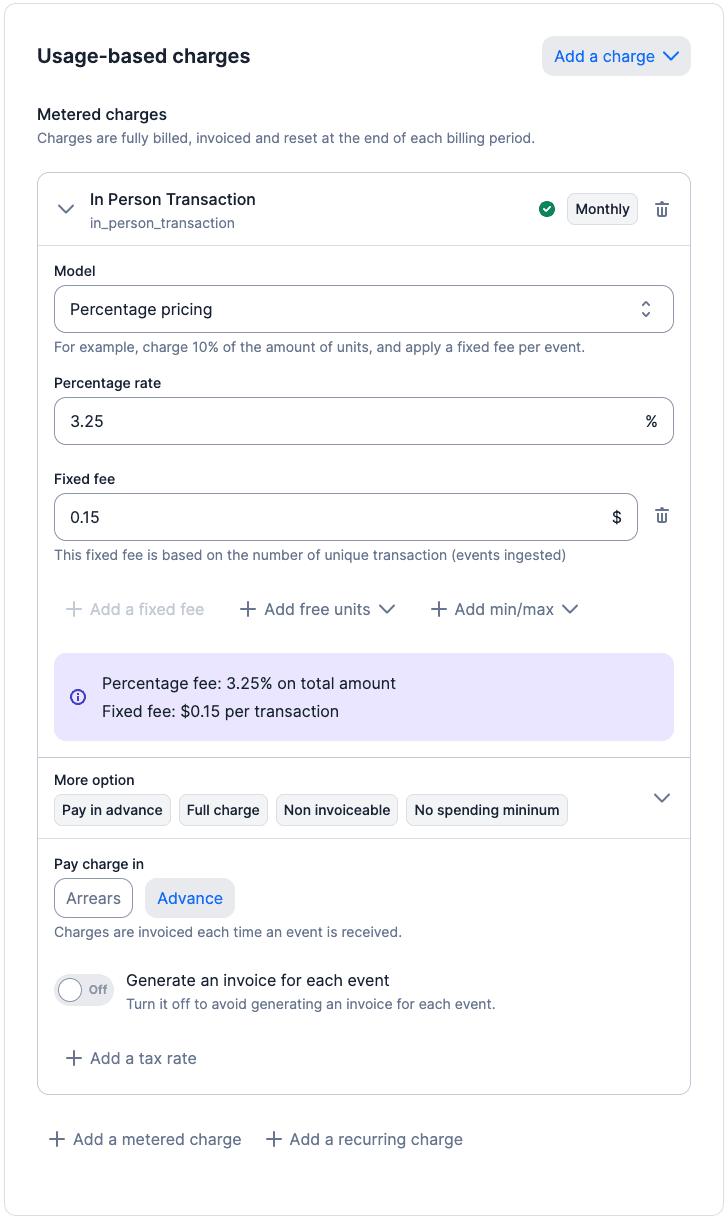

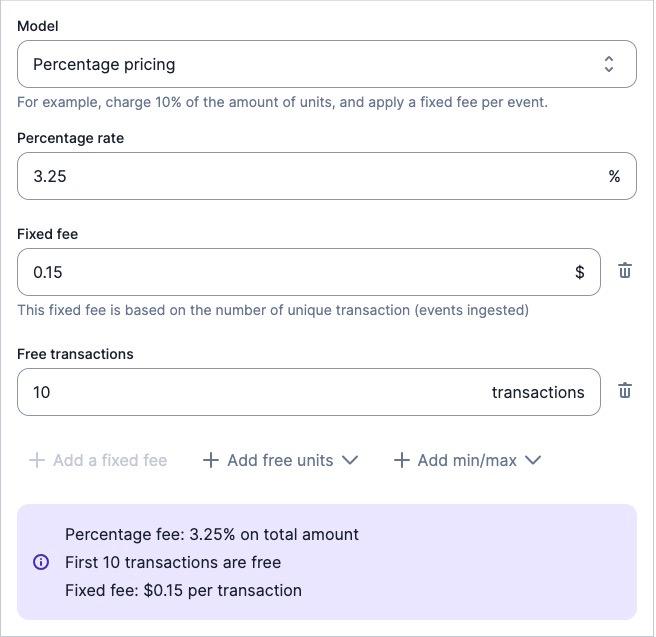

SumUp (the leading Point of Sale provider in Europe, similar to Square) charges $0.15 + 3.25% of the volume of transaction per payment. They take out these fees directly from the amount they receive from the end customer.

Here is how you’d replicate a similar pricing, effortlessly, within Lago:

You can give away free units based on transactions or spending. For example, offer the first 10 transactions or waive fees for the initial $500.

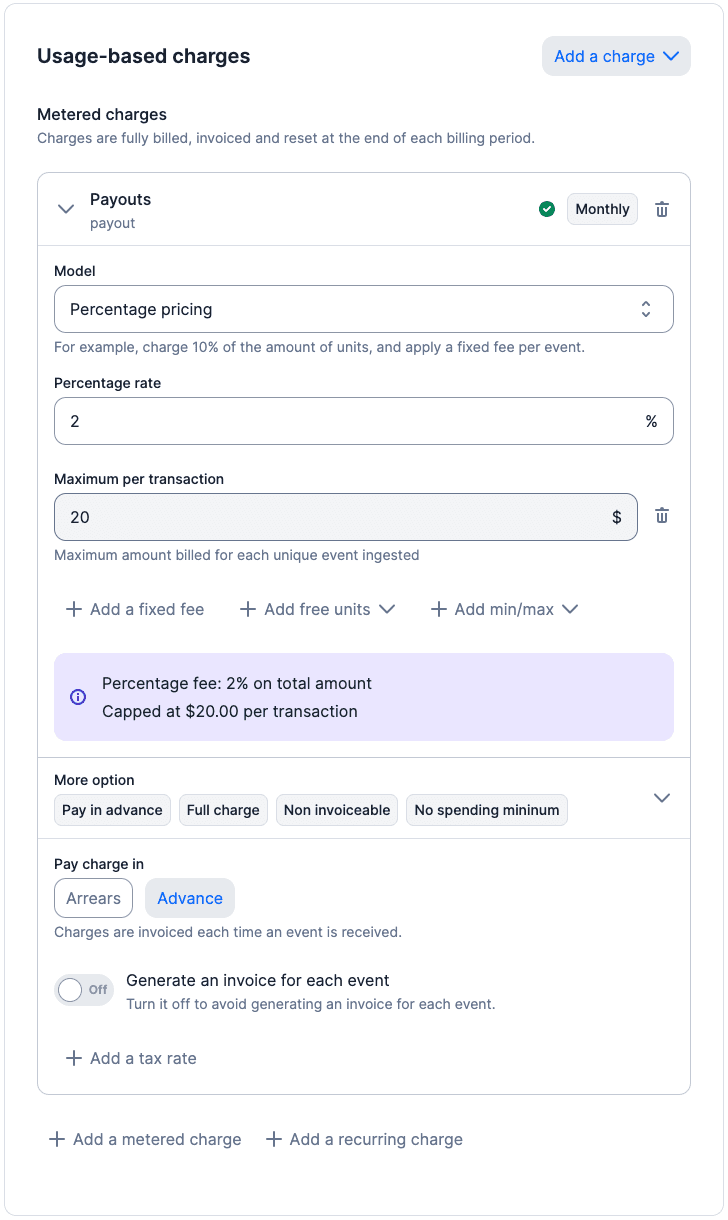

PayPal (the global online payment leader) charges 2% per PayPal Payouts transaction, capped at a maximum fee of $20.

Here is how you’d replicate a similar pricing, effortlessly, within Lago:

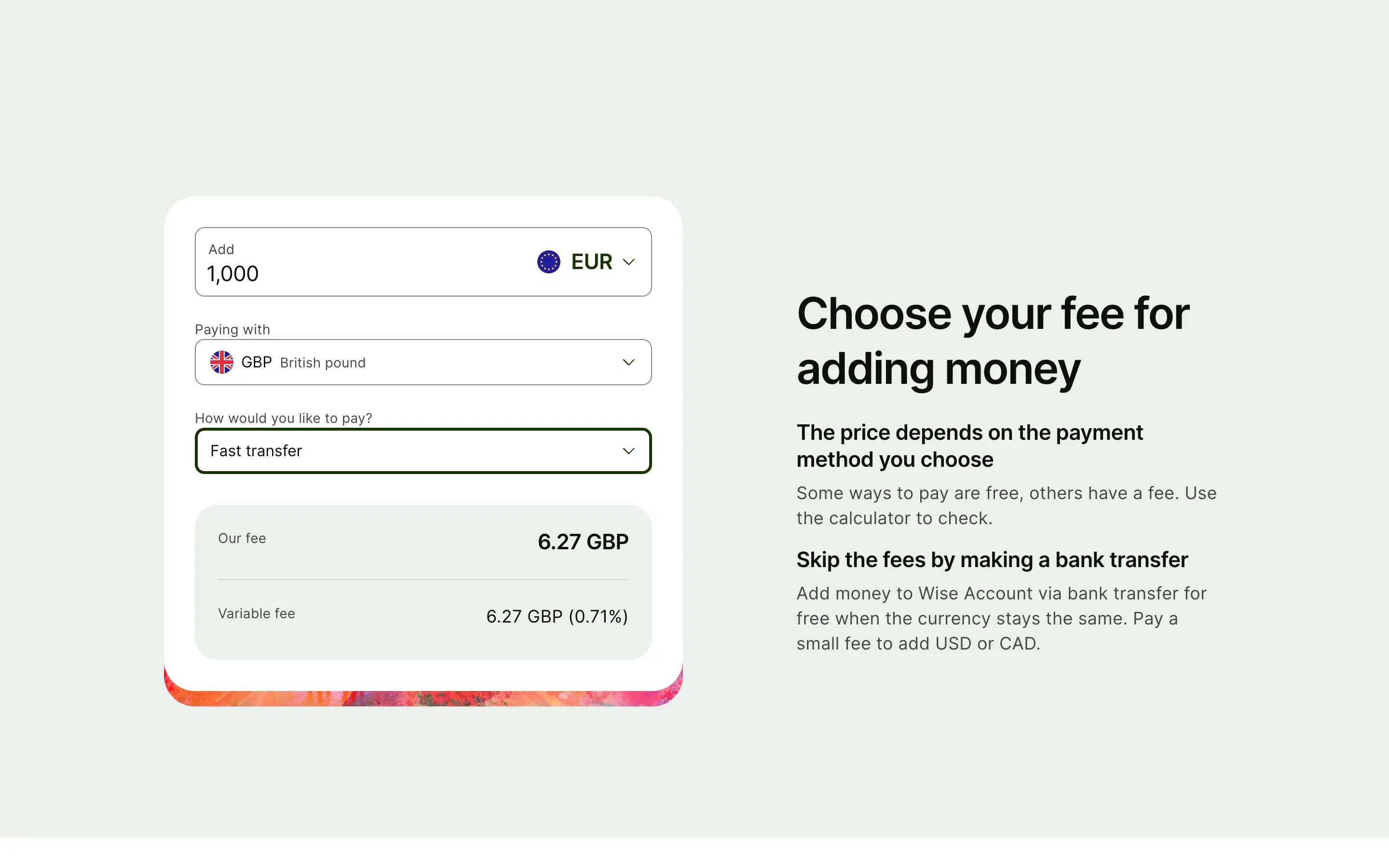

End users like to understand how much they’d have to pay, who doesn’t?

That’s why we’ve made it easy for you to provide full transparency to your end users on the amount of fee you’d be collecting with our ‘instant charge’ feature. This estimation is made in real-time by Lago, so that you can focus on your core product.

It’s also a best practice used by Wise.com in their fee simulator.

More information in our product documentation here.

That’s a wrap! Are you considering pricing payments, or fintech features? Would you like more information? Book a demo here, and/or join hundreds of billing and pricing professionals in our Slack.