Customer Stories

How 1NCE scaled global IoT billing with Lago

Finn Lobsien • 2 min read

May 23, 2025

/8 min read

Looking for usage‑based pricing examples? Below are eight real‑world SaaS examples from enterprises like AWS to startups like Relevance AI. Read to discover examples like pay‑per‑use, credit, percentage, and outcome models work.

Usage-based pricing charges customers for usage within a billing cycle. This means either paying a flat fee which includes limited usage or paying varied fees based on how much you use.

SaaS companies using usage-based pricing typically bill customers using measurable value metrics. The company tracks usage over a billing period, applies the unit price, and bills accordingly.

Usage-based pricing is most common in infrastructure (cloud services, databases, DevTools, APIs.) because costs per customer are more varied: A database customer with 100 users costs much less than one with millions of users. It wouldn't be fair to charge them the same.

With AI, usage-based pricing has arrived at the application layer. Apps are more likely to charge a subscription that includes usage (via credits or other forms of hybrid pricing) to keep it simple for users.

Usage-based pricing is unlikely to work in scenarios where users don't get value out of each bit of usage. For example, nobody would like to pay for Figma by the frame. A great example of this contrast is Anthropic's Claude, where the API is priced on usage while the app is paid for by subscription. The underlying AI is the same.

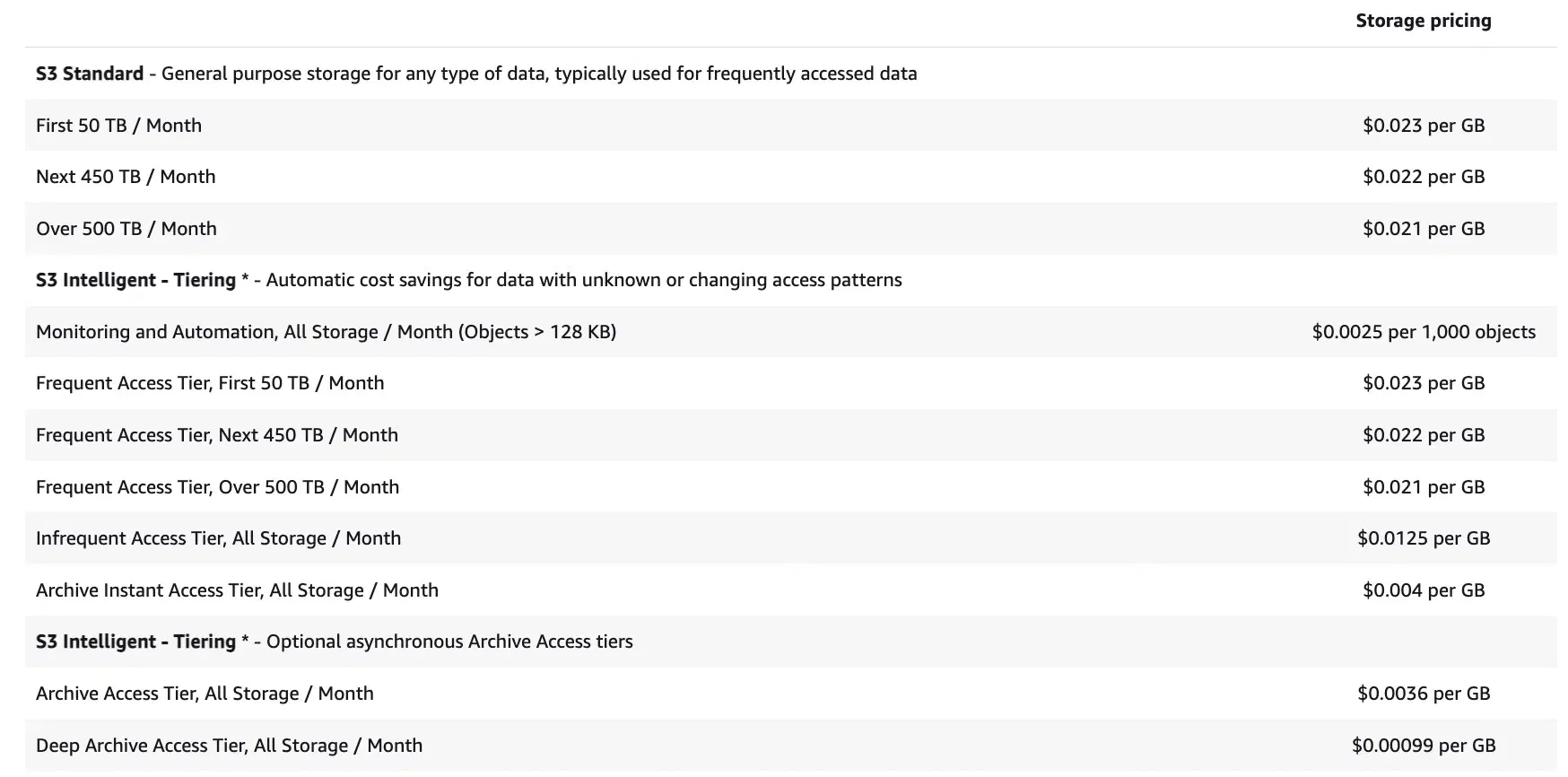

The "purest" usage-based pricing is to only charge for consumption. This is what AWS pricing looks like:

Customers pay no flat fee, only their exact usage. This is most common for infrastructure and cloud services like AWS and usually doesn't work for application-layer companies.

Consumption-based billing always means directly charging for a metric. Other examples include:

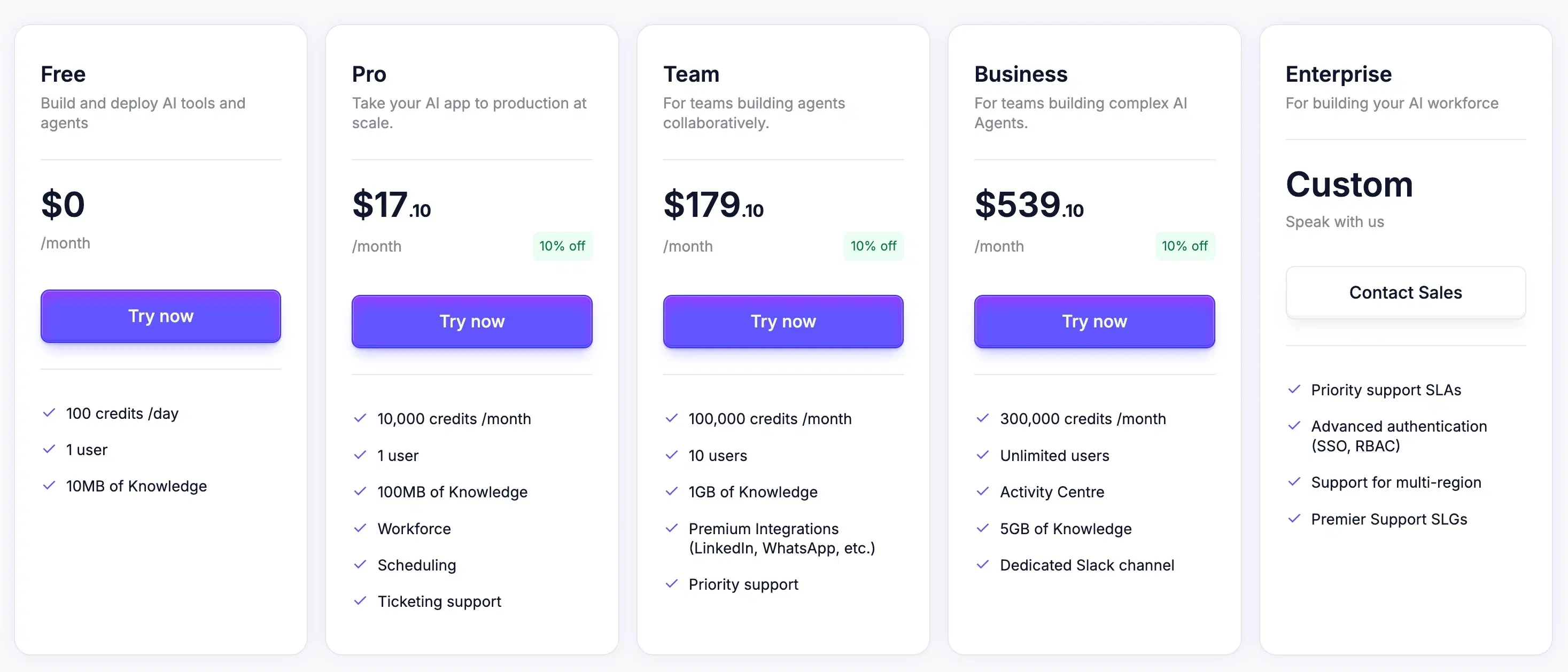

Credit-based pricing is perhaps the most popular AI pricing model for generative AI apps. It means issuing a number of credits to users which are included in their subscription. These credits can be spent on using the product. When users run out of credits, they can either top up their wallets by buying more or wait until credits are replenished at the next billing cycle.

Credits work best when users directly initiate usage and doesn't work well for infrastructure. That's because infrastructure should be reliable and in the background while other workflows are less essential. As an example: You wouldn't want your production database to run out of credits and stop working. But if an AI prospecting tool runs out of credits, you can wait a few weeks and use it again.

An example of this is AI agent platform Relevance AI:

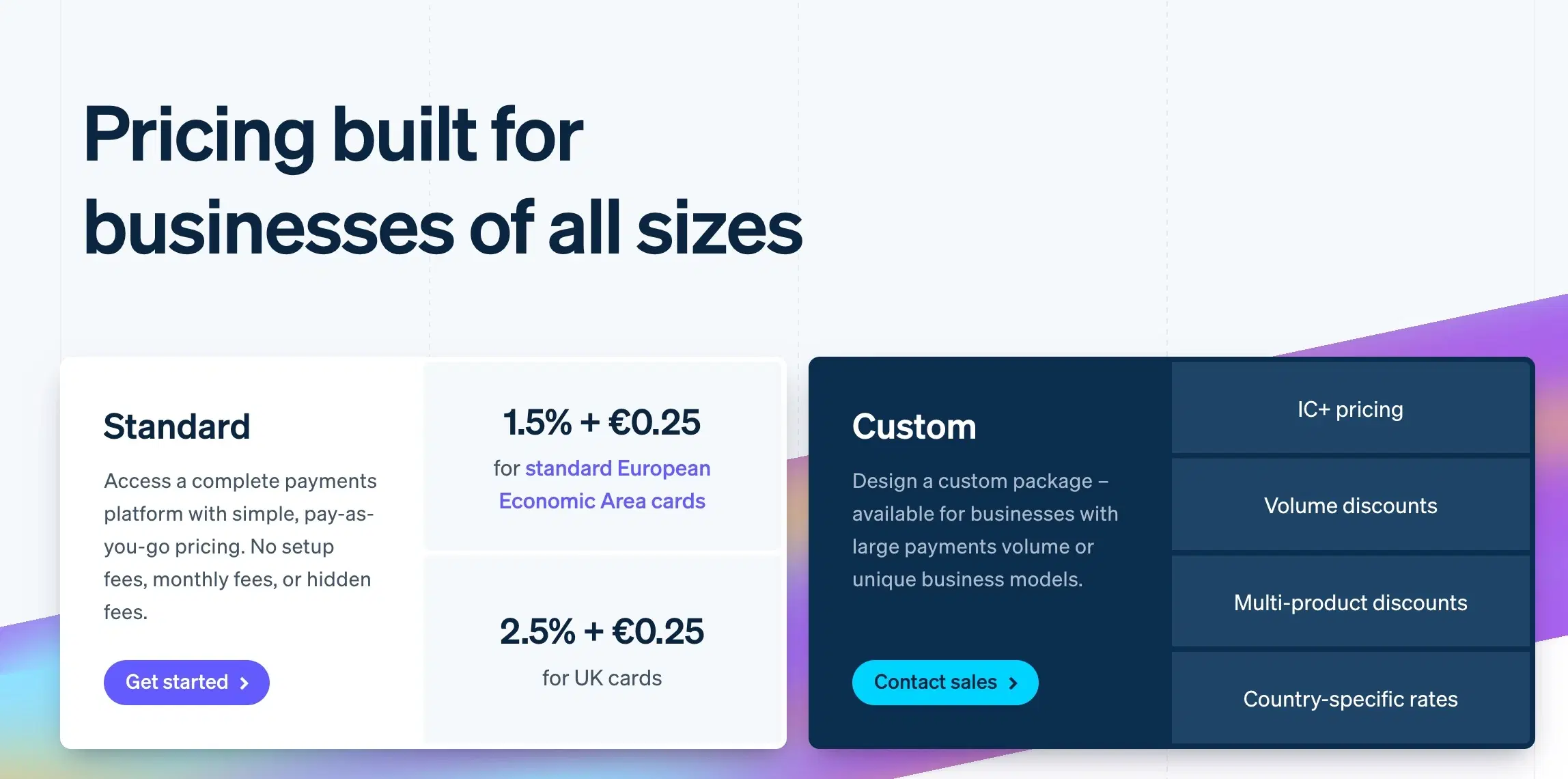

Some companies charge a percentage of another metric, typically revenue. This is a specialized example of usage-based pricing because it only applies rarely. A great example of this is payment provider Stripe, which charges a fixed percentage of a company's transaction volume.

Percentage-based pricing is rare. This is because it is rarely applicable. Few companies have enough visibility into customers' financial data to charge a percentage of anything.

But when you do, it can be a powerful example of usage-based pricing that directly corresponds with the customer's success.

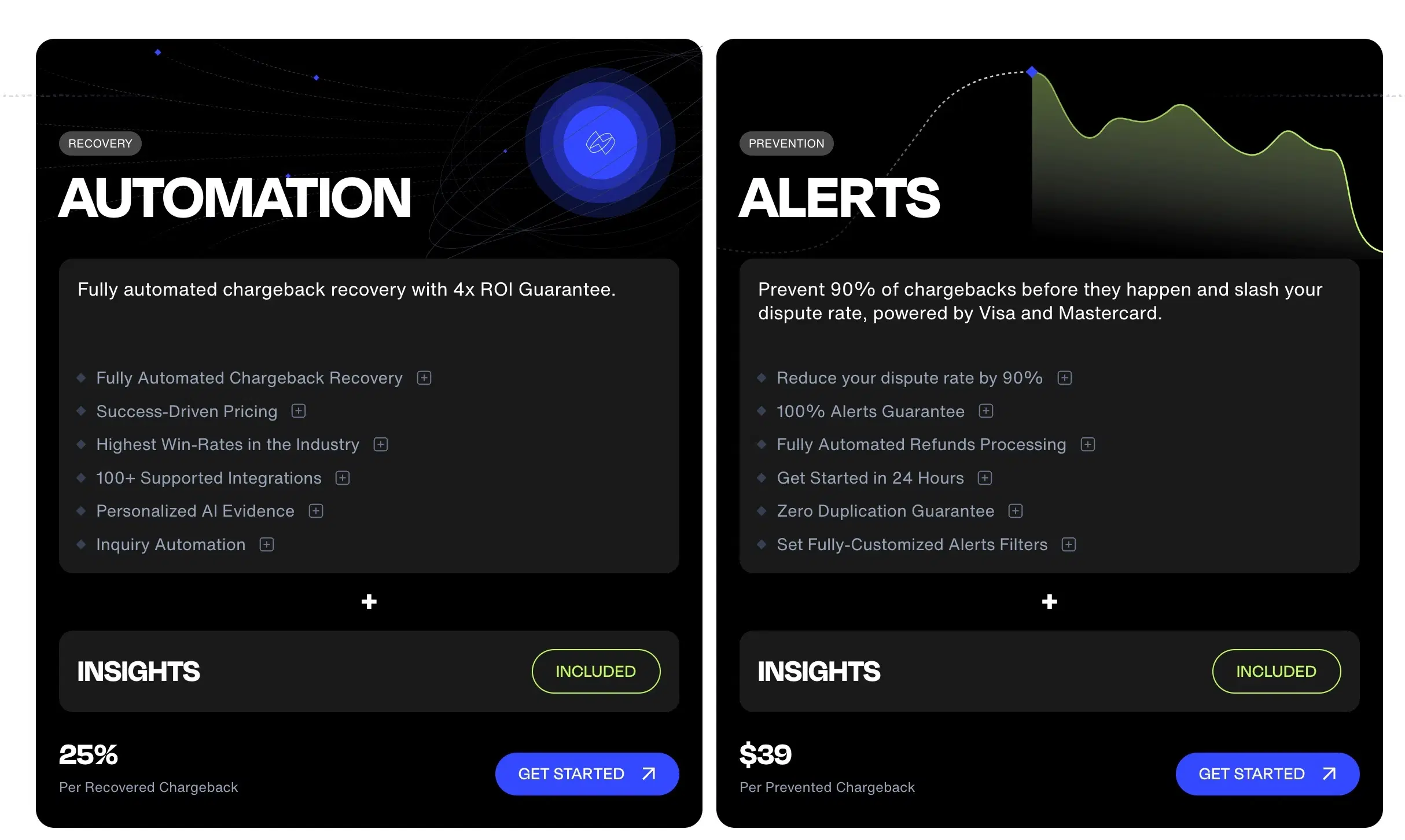

Outcome-based pricing is a novel example of usage-based pricing. It means only charging a customer for success. A great example of this is Chargeflow, a chargeback recovery product. It charges about 25% of recovered chargebacks (or $39 per prevented chargeback). In SaaS, this usage-based pricing strategy is enabled by AI. Previously, only (human-powered) services could do outcome-based pricing. Examples are commission-only sales agencies or recruiters.

In practice, most usage-based pricing strategies combine some of these into hybrid pricing models. If you want to implement some of these, here is a guide on how to build usage-based pricing in your SaaS company.

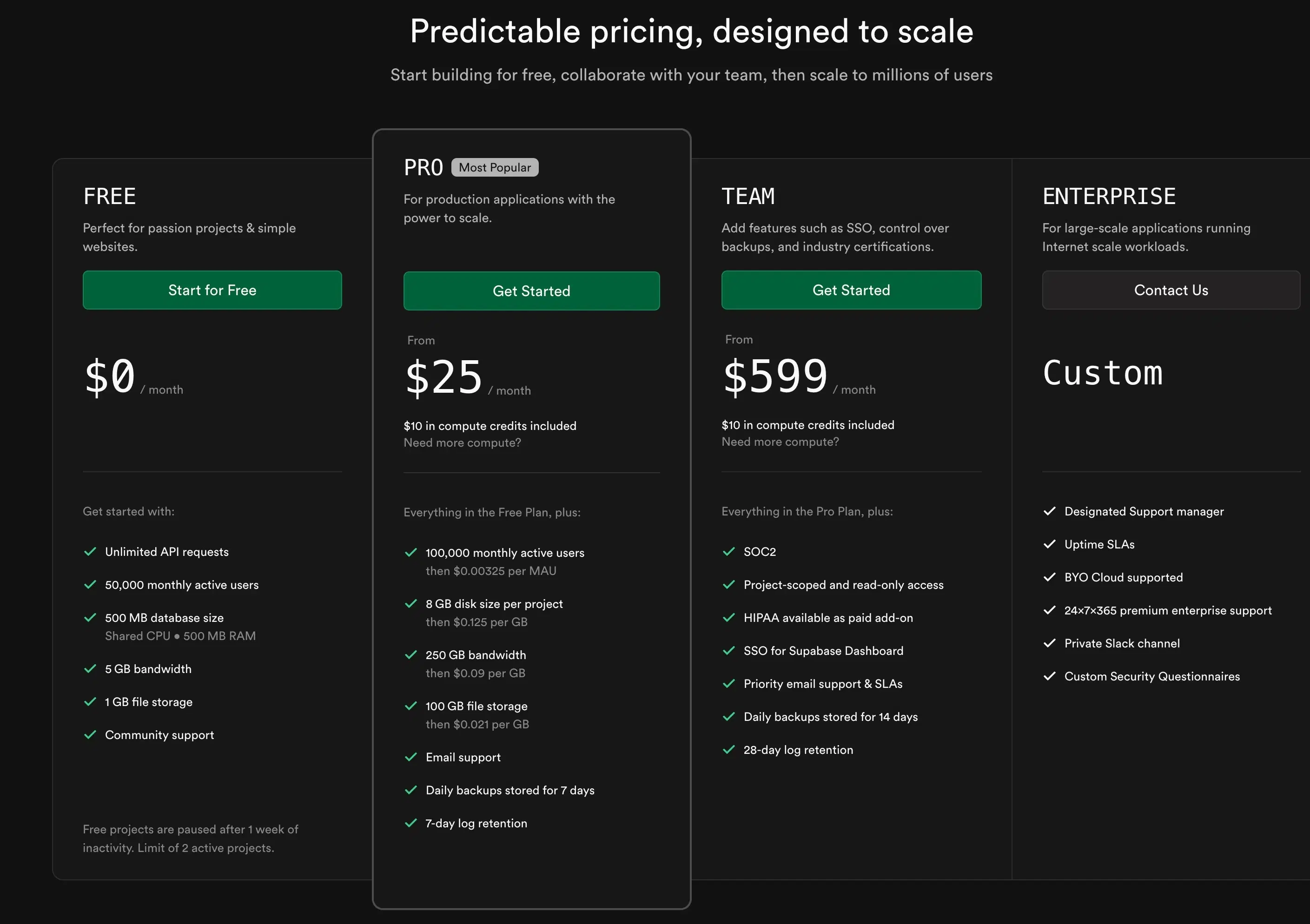

Hybrid pricing combines aspects of usage-based pricing with a subscription model. A great example of this is Supabase. The database company charges a subscription which includes usage and then charges a pay-per-use fee on top of it for additional storage or active users.

These hybrid models give users flexibility while still offering predictability. This model works for Supabase because it's a database that always runs in the background and has bad consequences if it stopped working once a customer has consumed all of their usage.

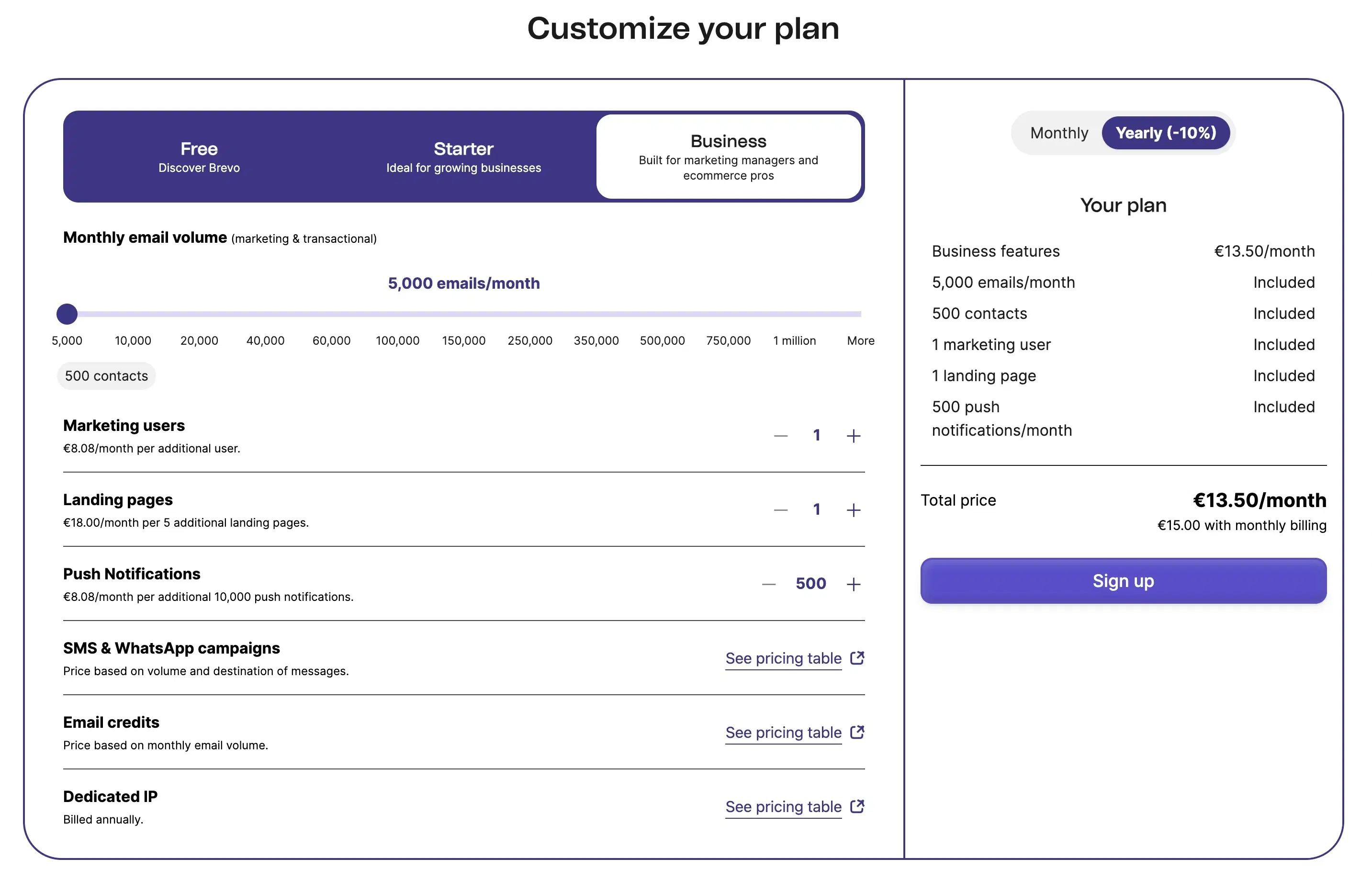

But hybrid billing models also exist outside of infrastructure. Take email and SMS marketing vendor Brevo as an example:

They charge a regular subscription and charge users extra if they use more notifications, users or landing pages. These hybrid models offer the best of consumption-based and subscription pricing. But hybrid pricing can also get overly complex.

Implementing usage-based pricing requires careful planning and the right infrastructure. Here are key considerations:

Modern billing platforms like Lago can help SaaS businesses implement and manage usage-based pricing models efficiently. With capabilities for real-time metering, flexible pricing configurations, and automated billing, such platforms eliminate many of the technical challenges associated with usage-based pricing.

The continued growth of usage-based pricing in SaaS is driven by several factors:

According to industry research, 61% of SaaS companies are looking to launch consumption-based models, indicating that this trend will continue to strengthen in the coming years.

UBP charges customers for actual consumption—whether API calls, data rows, or credits—instead of a flat monthly seat fee.

Seat‑based ties cost to users; flat‑rate is one price for unlimited use. UBP scales costs (and value) with measurable activity, aligning spend with usage.

Common value metrics include tokens processed, inference seconds, images generated, or characters translated—anything closely tied to cloud‑compute costs.

Use a hybrid when you need predictable recurring revenue and want to let power users burst beyond included usage without upgrading tiers.

Offer real‑time usage dashboards, spend alerts, and hard limits or auto‑top‑ups so buyers stay in control.

It can add volatility, but cohort analysis, usage caps, and minimum‑commit contracts improve predictability while preserving upside.

You’ll need metering, rating, and invoicing that handle high‑volume events in near‑real time—tools like Lago, Stripe Billing, or custom Kafka pipelines.

Choose a metric customers understand, map it to delivered value, and ensure you can measure it accurately and cheaply.

Rarely. If users don’t perceive incremental value per action (e.g., drawing a Figma frame), UBP feels punitive; subscription tiers work better.

When priced fairly, churn often drops because users aren’t forced to over‑subscribe; they can scale down during quiet periods without canceling outright.

Best‑in‑class usage‑based companies report 120 %–140 % NDR, driven by organic expansion as customer usage grows.

Communicate early, grandfather legacy plans, and offer usage credits or discounts during the transition to build goodwill.