Startup Stories

Lago Manifesto: Building billing shouldn't suck (for neither business nor eng)

Finn Lobsien • 5 min read

Apr 25, 2022

/4 min read

This article was originally published on Sifted on November 1st, 2021.

——

Europe’s tech ecosystem needs more investors and more diverse sources of capital at the earliest stages. What it doesn’t need more of? VC scout programmes.

Scouts are a special kind of startup hunter that more VCs in Europe are relying on to discover promising companies early. Great for VCs and scouts, but not so great for founders.

Scouts are ex-founders or operators with a great network within their ecosystem, hence a good capacity to find early-stage companies before anyone else does. They often already have a full-time job or are running their own company.

Scouting is a way to learn closely how VCs think — risk-free. Scouts don’t invest their own money, but the firm’s. They might get a cut of the investment returns in the deals they help close, but it’s too long term to be their main motivation.

“The startup is getting none of the boost to recruiting and sales that having a high-quality, brand-name investor can provide”

For VCs, scout programmes are a great way to source deals in geographies or industries they would not be looking at naturally or don’t have a physical presence in. It also gives them exposure to very early-stage deals for very low stakes (€20k to €30k). That’s pretty cheap to get an inside look at a startup’s performance and potentially have a relationship that will allow you to preempt investment by other VCs down the line.

On the other hand, founders get the short end of the stick.

They don’t get much cash from scouts, and they can’t use a VC’s brand when they receive investment. For example, if a Sequoia scout invests in a startup, the startup can’t say that they’ve received investment from Sequoia because it was not Sequoia that made the investment decision, even if the money came from Sequoia. So the startup is getting none of the boost to recruiting and sales that having a high-quality, brand-name investor can provide.

There’s also a tricky question of optics. While the startup can’t use the VC’s name and the VC’s name doesn’t appear on the cap table, everyone knows that the scout who invested did so on behalf of such-and-such VC’s scout programme. So when said VC doesn’t invest at a later stage, the optics aren’t great, are they? It’s basically saying that the VC didn’t think the startup was good enough. That can make fundraising from other investors difficult.

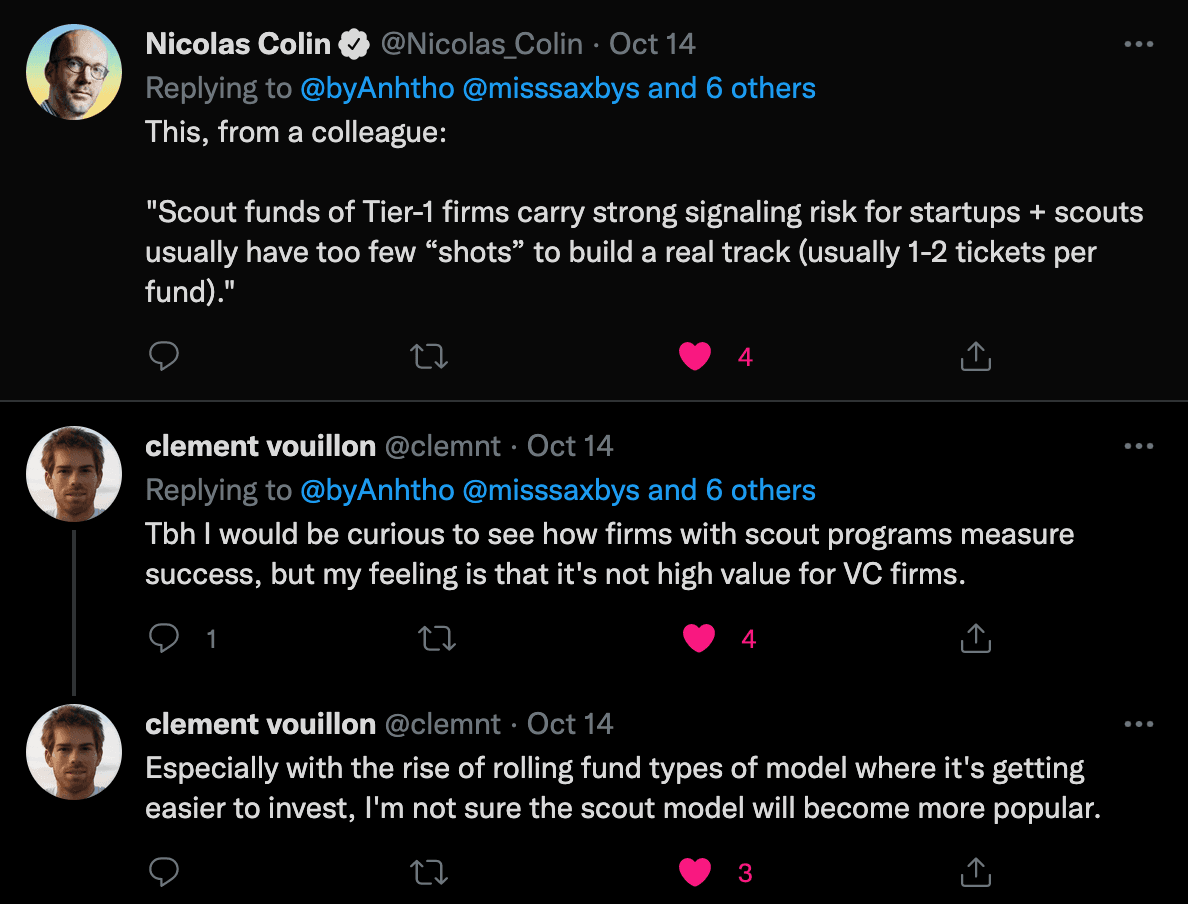

It’s not just me, either.

Some argue that these downsides for founders shouldn’t matter because scouts mean more capital at the earliest stages. But this ignores the fact that Europe’s angel investing ecosystem continues to mature and grow stronger. If the question is about encouraging more investment at the earliest stages, Europe should be talking about encouraging and empowering operator angels, not VC-funded startup bounty hunters.

The most valuable investors for startups are those with skin in the game.

A scout does not have that when they invest because it’s not their money. So your startup is not going to be a priority for them in terms of providing advice or support. That’s why startups would be better off taking money from independent angels who will be investing out of their own pockets.

VCs can have skin in the game at the earliest stages, but it doesn’t have to involve scouts. A number of US firms focused on Series A or B invest at earlier stages with flexible terms, no rules about how little of the company they can own and with tickets from $50k to $500k, such as Jay Simons’ Bond (ex-president at Atlassian), or Lee Fixel’s Addition.

Those cheques — much larger than the ones scouts usually write — can make a meaningful difference. And the investment is managed directly by the firm itself, which means founders actually get the official support of the firm.

“Europe should be talking about encouraging operator angels, not VC-funded startup bounty hunters”

The flexibility of the terms is important: lots of VCs in Europe would want to take at least 15% of the company at seed, and startups don’t always intend to sell that much equity to a single fund.

This model is not perfect either. Indeed, great funds at Series A/B are not necessarily great at supporting founders through seed stages and there can still be the optics problem if the fund doesn’t invest again at a later stage. But these funds have a great network of later-stage founders, operators and best practices an early-stage team can benefit from.

Some microfunds also have a disruptive approach. US-based Sahil Lavingia, Gumroad founder, spearheaded one of the first next-gen scout programmes. Indeed, his scouts get carried interest in the whole fund, not just the referred deal, which is much better for the scout. In addition, scouts are selected through an open online application process, rather than an opaque “invitation-only” system. Last, whether the deal was scouted or selected by himself directly, it’s his name that appears on the cap table.

“Overall, I don’t mind the traditional scout programs, but I think they could be improved. If my fund succeeds, I hope to beat the drum and encourage that change. And why do I care? I want 100x the amount of people to own equity in startups,” Lavingia says.

Let’s hope it’s not long before we see something like this in Europe.