Pricing & Monetization

Why Stripe paid $1B for Metronome instead of fixing Billing

Anh-Tho Chuong • 8 min read

Jul 21, 2022

/5 min read

Disclaimer: This analysis is based on Stripe’s public pricing as of July 21, 2022. Some merchants may be able to negotiate fees or benefit from grandfathered plans. Please get in touch with us if you have any questions or comments.

“How much do you pay for Stripe?”

We asked this question to dozens of SaaS founders and none of them was able to provide a precise figure. Answers ranged from 4 to 8% of their revenue.

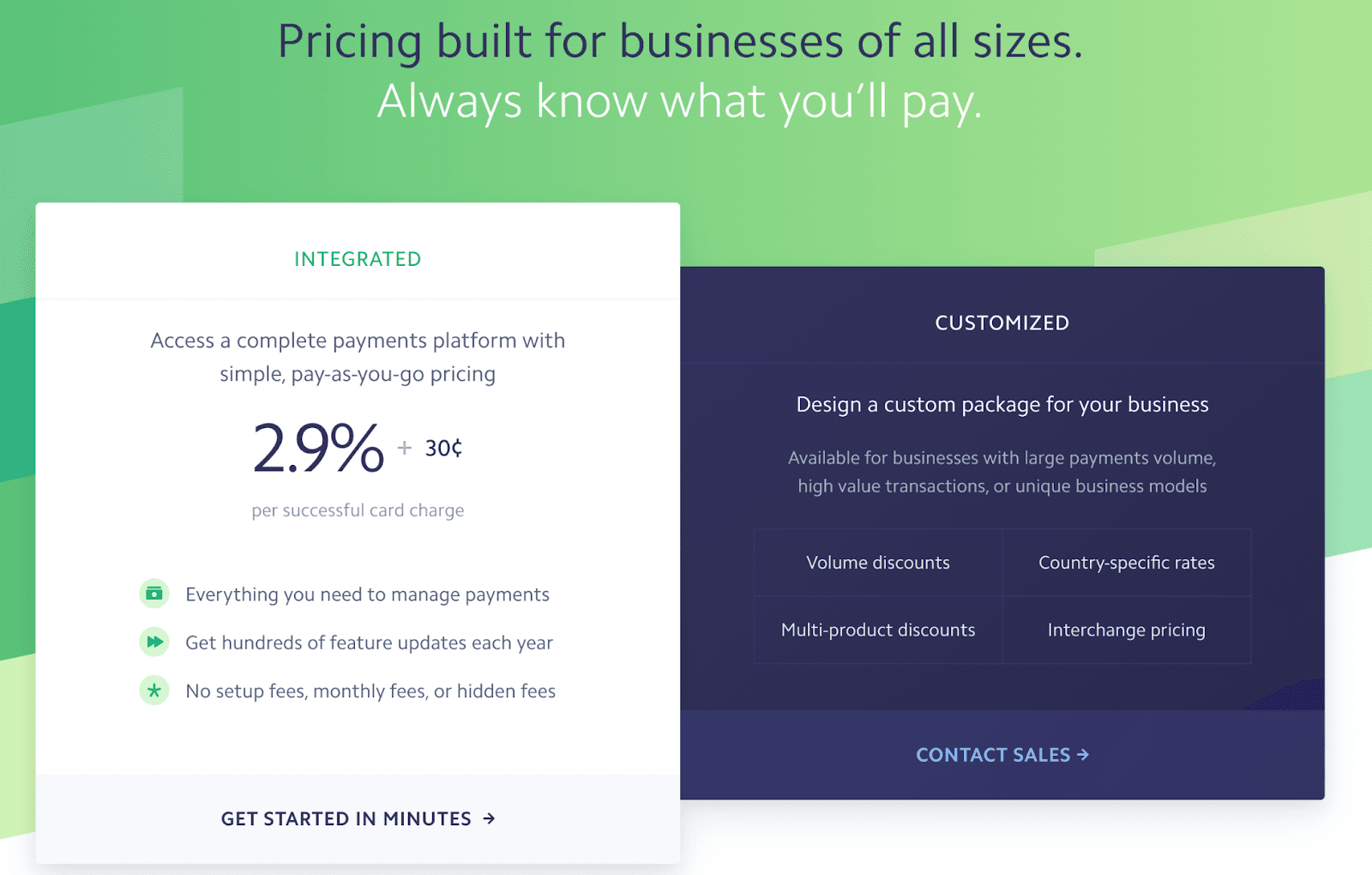

Why is that? As Stripe is mostly known for its payment processing platform, its fees are generally perceived as card processing fees. Simple, transparent: “Always know what you’ll pay”, as the slogan says.

However, Stripe not only offers Stripe Payments but also 20 other products. The payment processing fees may be clear, but as you often need to use a combination of these products, Stripe’s pricing quickly becomes complex.

Let’s review the different use cases featured on Stripe’s website. How many products are required? How much of your revenue will you leave to Stripe?

Stripe features the example of “Typographic”, a B2B SaaS company with a typical SaaS pricing page, including three subscription plans.

Below is a list of all the Stripe products you might need to replicate this business model, and direct costs.

*If only card payments are taken into account ‒ additional fees apply for bank transfers, additional payment methods (e.g. SEPA debits) and instant payouts.

**Only if all payments are made by national cards.

A vertical SaaS is a cloud-based company that focuses on the specific needs of an industry, or a vertical. Toast is an example of a vertical SaaS that provides an all-in-one digital technology platform purpose-built for the entire restaurant community.

Mindbody is another leading vertical SaaS for the wellness industry (i.e. business owners, wellness seekers and enterprise businesses). Their product line covers appointment management, class calendar management, and payments. For instance, a yoga studio that uses Mindbody can collect payments from its students through Mindbody’s platform, which itself relies on Stripe.

A vertical SaaS usually has two revenue streams:

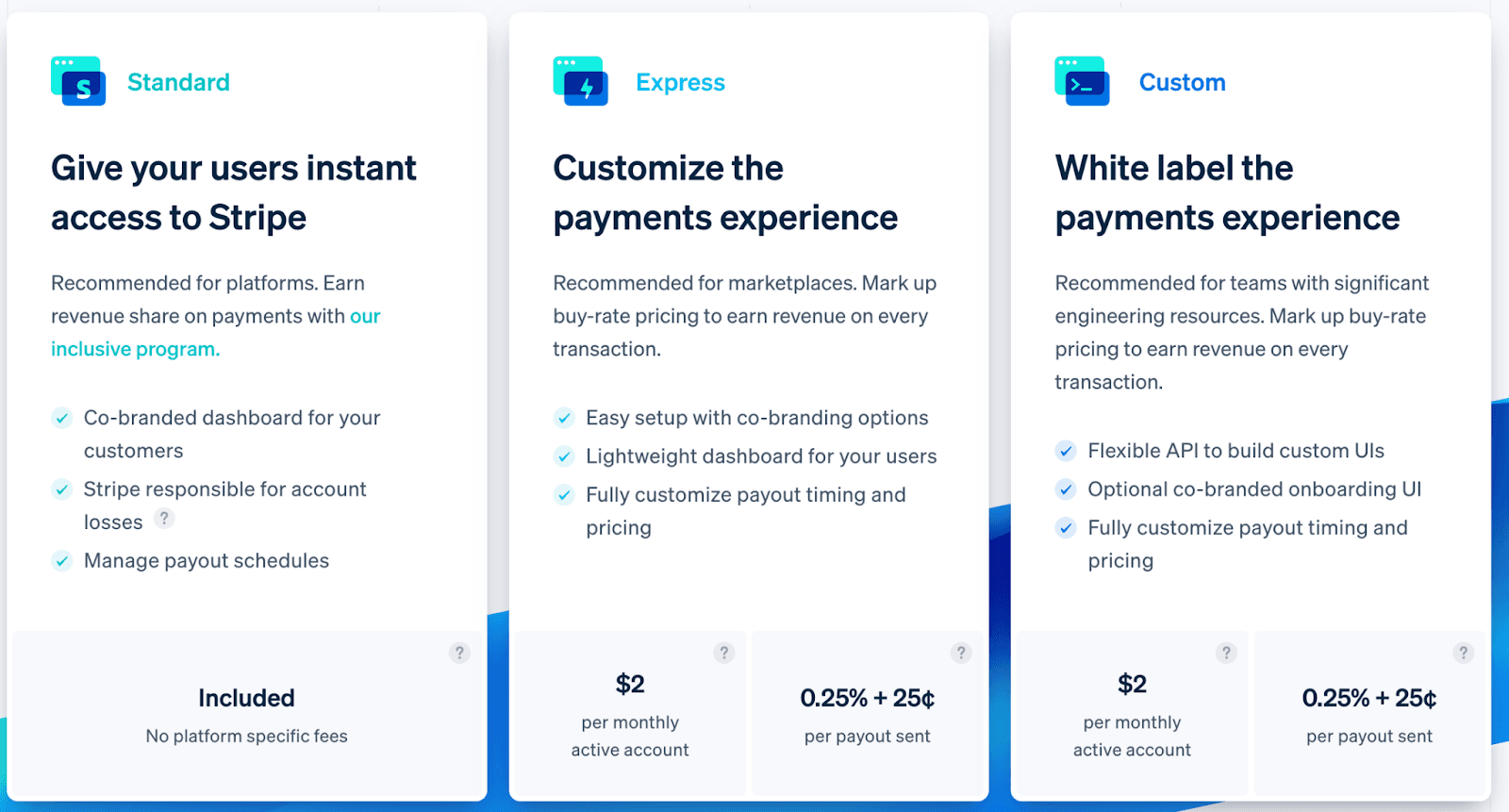

A vertical SaaS would use the same set of products as Typographic (see example 1) and would also use Stripe Connect to redirect payments to merchants (i.e. when the vertical SaaS company collects payments from the customer, it deducts its fees and then sends the remaining amount to the merchant).

Stripe Connect costs $2/month per active account and there’s also a transaction fee of $0.25 + 0.25% (in addition to the cost of Stripe Payments and other Stripe products).

These are the direct costs of Stripe’s products, but what about indirect costs?

Stripe may be the best payment processing API on the market, the implementation of its product suite still requires engineering resources.

Although no developer would like to “reproduce” Stripe Payments in-house, the question is worth analyzing for the other products: billing, invoicing, revenue recognition, checkout, etc. Using Stripe products beyond Stripe Payments means adapting your business processes and pricing model to Stripe’s products. In addition to this, you will have to pay rent to Stripe.

These are significant costs.

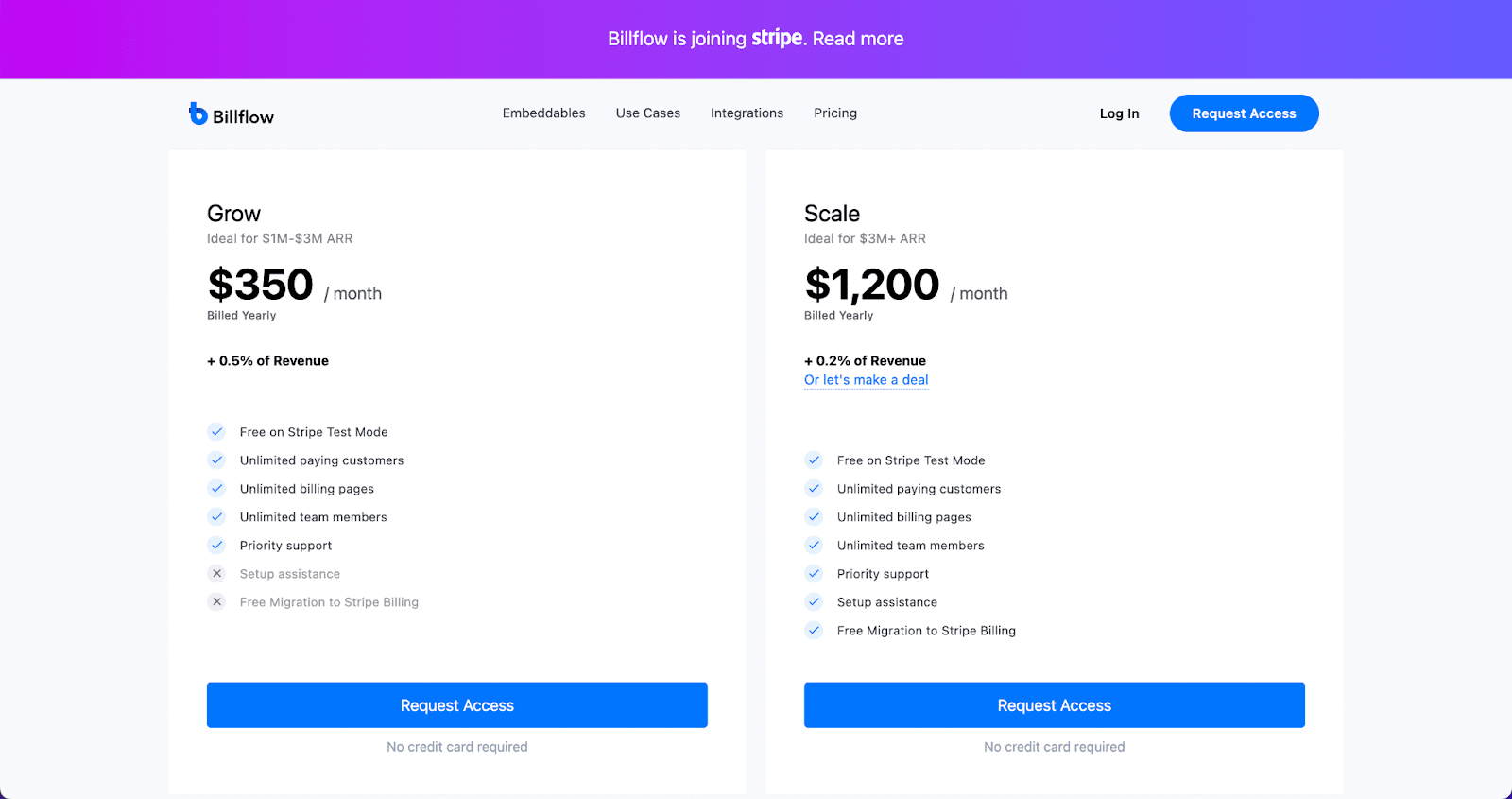

A company called Billflow even built a user interface on top of Stripe Billing to make it simpler to use... and has been acquired by Stripe itself. Its pricing was similar to Stripe’s, with a hefty percentage of revenue.

Imagine that you use Stripe Billing to manage subscriptions and Stripe Payments to collect payments from your customers. You would like to connect your billing software to another payment provider, such as:

Well, you can’t. You only have two options:

The more you rely on Stripe products, the harder it is to keep your options open and have leverage when negotiating fees.

Switching payment solutions is painful and can become a nightmare if your current solution is Stripe Payments and your billing system (i.e. Stripe Billing) can’t connect to another payment processor.

Stripe knows that, which is why they can raise prices and charge for features that were initially included in Stripe Payments – see the Hacker News conversation about Stripe Billing’s pricing (up to 0.8% for a product that was initially included in the Stripe Payments offer).

Many customers try to negotiate Stripe’s rates but it’s an arcane process and custom contracts often come with a multi-year commitment. A few teams shared their experience:

An increasing number of teams are attempting to de-risk their relationship with Stripe. The payment API is top-notch, and they want to keep using it, but they are introducing other payment gateways as well, to control their spending and introduce healthy competition. For instance, agnostic solutions like Primer and Inai make it easier to manage the checkout experience.

On the billing side, implementing an agnostic solution that can connect to any payment, invoicing or analytics software also allows you to build a strong financial stack.

We have the greatest admiration for Stripe. However, as former customers, we don’t agree with the “rent seeker” approach and closed ecosystem model, which is why we decided to create an open-source billing API. More about our story here.

Content