Stripe's per-transaction pricing

Note: Stripe’s product suite includes 21 modules. In this article, ‘Stripe’ refers to Stripe Payments, the global payments platform and main module of the Stripe suite.

___

Implement a per-transaction pricing model like Stripe, the leading payments infrastructure company, including fees based on the total amount and number of transactions.

What's in it for you?

In this article, you will learn how to build a ‘pay-as-you-go’ billing system, where a single event can trigger multiple instant charges.

This template is suitable for companies whose pricing depends on transactions, such as fintechs and marketplaces that deduct their fees from their customers’ revenue.

What's the secret sauce?

Stripe offers ‘pay-as-you-go’ pricing based on successful card charges processed via its platform. Stripe’s API includes many payment options and rates vary depending on the payment method.

(based on transaction amount)

(per transaction)

As Stripe supports more 20 payment methods in the US and most of them share the same charge model, we will focus on online card payments.

Here’s how you can replicate this pricing with our billing solution.

What do you need?

The first thing to do is to create your company account on Lago Cloud or deploy Lago Open Source on your existing infrastructure. In both cases, you should ask a back-end developer to help you with the setup.

Our documentation includes a step-by-step guide on how to get started with our solution.

Instruction manual

Step 1 – How to record transactions

Lago monitors consumption by converting events into billable metrics. For Stripe’s per-transaction pricing, we can create a billable metric for each payment method.

Using the ‘sum’ aggregation type, we create a billable metric that will allow us to record transactions.

In this case, the aggregation type is metered. It means the aggregated amount is reset to 0 at the beginning of the next billing cycle.

When a successful card charge is processed via the platform, our backend system will generate an ‘online_payments’ event, including the transaction amount.

Step 2 – How to set up a ‘pay-as-you-go’ pricing model

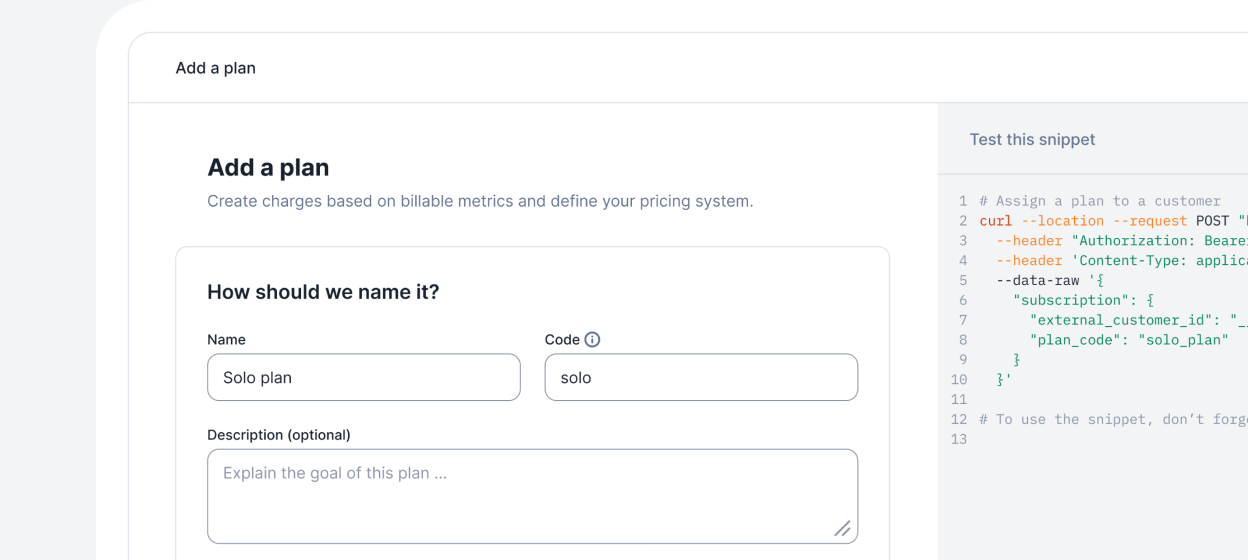

When creating a new plan, the first thing to do is to define the plan model, including billing frequency and subscription fee. Here we can select the monthly plan interval. As we are implementing a ‘pay-as-you-go’ pricing model, there is no subscription fee.

We want our customers to pay for their use of the payments platform, so we add charges to our plan. Each charge is associated with a billable metric (i.e. one charge per payment method in this case) and has its own pricing structure. In order to replicate Stripe’s pricing, we select the percentage metered charge model then choose Pay charge in Advance. Additionally, the option to generate invoice for each event should be turned off as Stripe doesn’t bill customers for individual transactions.

The percentage charge model allows us to combine a percentage charge based on the amount of the transaction and a fixed fee.

If you want to charge your user on this usage on a monthly basis, you can set up the same way using the Percentage charge model and charge it in arrears.

If we wanted to go even further, we could define free units. For instance, we could:

• Offer the first three transactions; or

• Offer the first $1,000; or

• Create a model where the first three transactions or first $1,000 would be free of charge.

Wrap-up

For fintech companies like Stripe, implementing a per-transaction pricing model is a good way to increase revenue as customers grow and capture value everytime a transaction is processed.

With Lago, you can create your own billable metrics and use the percentage charge model paid instantly to adapt this template to your products and services.

Give it a try, click here to get started!

Two hosting options, same benefits

Whether you choose the cloud version or decide to host the solution yourself, you will benefit from our powerful API and user-friendly interface.

Lago Premium

The optimal solution for teams with control and flexibility.

Lago Open Source

The optimal solution for small projects.